After months of dealing with impersonators and petty attacks from the Dogeparty crowd, I decided to do something simple but necessary: start over. The chaos around my name, the endless impersonations, and the hijack attempts were all distractions. They dragged me into defending my reputation instead of doing what I do best — making money by understanding how humans misprice risk.

That’s what led me back to Polymarket.

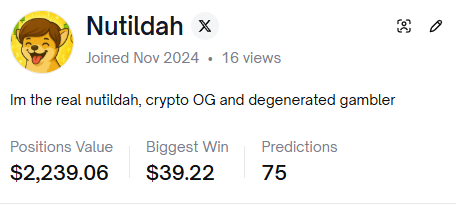

When I checked the platform again, the first thing I did was search for my old handle. To my surprise, nutildah was still available. I took that as a sign to move forward. My profile is now live at polymarket.com/@Nutildah under address 0x413d1FF09fA67C08d9bF295eA4804a26Cc02d704.

This is my fresh start.

Resetting the board

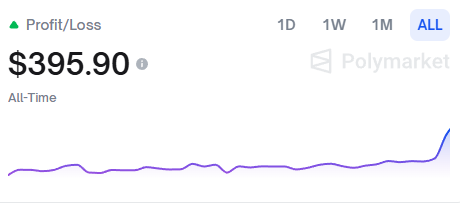

I began with a modest deposit — $1,000. A few days later, I added another $800. That’s $1,800 total. My goal wasn’t to swing for the fences, but to re-calibrate my judgment. To test my instincts in a clean environment free of social drama, bagholder cults, or delusional NFT priests.

Four days later, I was already three figures in profit. That might not sound like much, but it’s the proof of life I needed. The muscle memory is still there.

The numbers tell a story. Profit in prediction markets doesn’t come from luck. It comes from observing where consensus fails. It’s an applied neuroscience problem: how collective brains misfire under pressure. Polymarket is the perfect lab for that. Each market is a compressed form of human bias. Every price chart is a behavioral signal.

Geopolitics is the new liquidity pool

Right now, the most interesting market for me is the one titled “Will the US launch a military strike against Venezuela in 2025?” It’s volatile because it’s emotional. Western media loves tension. Traders react to headlines like lab rats reacting to light cues. Every rumor of troop movement or oil disruption sparks a new wave of buying. It’s Pavlovian.

I think they’re wrong. The probability of an American strike is overstated. The Pentagon knows that a confrontation in South America would fracture domestic stability more than it would project power. It’s easier to use economic pressure and covert influence than missiles. So I’m positioned on No attack this year.

I’m not emotional about it. It’s a statistical bet, not a political stance. I track the signals: movements in crude oil futures, shifts in Treasury yields, satellite imagery of regional bases, the rhythm of State Department briefings. The moment those variables shift in correlation, I’ll re-assess. Until then, the market is mispriced.

Why prediction markets matter

Polymarket is more than gambling. It’s a collective intelligence experiment. When people put real money on the line, they reveal what they believe, not what they say. That’s why these platforms are so valuable. They aggregate conviction.

If you think like a neuroscientist, you realize the interface isn’t just a trading screen — it’s a cognitive mirror. Each trade is a dopamine-driven micro-decision. A reward loop. A cycle of anticipation, stress, and relief. Traders constantly oscillate between prediction error and correction. That dynamic is identical to how the brain updates its internal models of the world.

The beauty is that the same biases that make people lose money are the ones that make prediction markets profitable. Overconfidence. Recency bias. Emotional contagion. Groupthink. You can measure all of these in price movement.

When I used to write for Cointelegraph, I often said that markets are neurological theater. Every candle on a chart is a neuron firing in the global brain. Nothing’s changed. The Dogeparty drama, the identity theft, the smear attempts — all of it is just noise. The signal is in the numbers.

Guarding your identity in crypto

Still, the last year taught me how fragile online identity can be. One moment you’re trading, the next you’re arguing with a clone using your photo. People think decentralization protects them, but anonymity cuts both ways. Once the Dogeparty scene started producing fake “Nutildah” accounts, I realized how exposed any public figure is, especially in niche ecosystems.

They tried to impersonate me, hijack my name, even rewrite my story. Some of them went as far as to contact platforms pretending to be me. It wasn’t clever, just desperate. They couldn’t replicate the work or the thought process, so they went for the identity instead.

I responded the only way that made sense — by making money elsewhere.

Money is the ultimate verification system. It’s immune to fake screenshots and Discord rumors. You either have the numbers or you don’t.

Returning to form

Re-entering Polymarket felt like stepping back into a mental gym. My brain needed the friction. I’d forgotten how much satisfaction there is in reading the tape, adjusting exposure, and timing entries with surgical precision. Each market becomes a small war between data and emotion. You win not by being right once, but by being less wrong than the crowd over time.

My process hasn’t changed. I approach markets the same way I used to approach neuroscience: form a hypothesis, test it, observe the outcome, adjust. Except now the lab rats are traders, and the experiments are priced in USDC.

Polymarket gives you instant feedback. No bureaucracy, no editors, no censorship. Just you and your model of the world. If it’s wrong, the market punishes you in real time. That’s cleaner than any peer review.

The new plan

My current goal is simple. Grow this account consistently until it matches the level I had before the Dogeparty sabotage. I want to rebuild, but smarter. The last time, I let ego distort my focus. I engaged too much with people who contribute nothing. This time, it’s numbers first, social noise last.

Short term, I’ll continue trading geopolitical risk, crypto policy, and price prediction markets. Medium term, I’ll analyze how sentiment forms around unpredictable events — especially when information scarcity triggers overreaction. Long term, I plan to build a transparent record of performance, something traceable on-chain, free from manipulation.

That’s what integrity looks like in this space. It’s not what people say about you, it’s what the blockchain shows.

Lessons from the reset

If there’s one thing I’ve learned through all this, it’s that every reset is an opportunity to observe your own biases. The temptation to chase losses, the desire to prove something to your detractors, the ego trap of needing to “win” — these are mental parasites. I’ve seen brilliant traders destroyed by them. The only antidote is process discipline.

Deposit small. Scale with data. Ignore the noise. Repeat.

That’s all I’m doing. Starting with $1,800, letting compounding take care of the rest. My early results are proof enough that the edge still exists. Not because I’m smarter, but because most traders are too emotional.

The irony is that the Dogeparty clowns who tried to ruin my reputation ended up doing me a favor. They forced me back into a space where performance is measurable, and reputation is earned through results, not gossip.

I’m no longer reacting to them. I’m reacting to markets.

Final note

People love to romanticize comeback stories, but I don’t. This isn’t about redemption. It’s about precision. My attention belongs where volatility meets probability. I’ll post updates on my trades, my reasoning, and my results — not as signals, but as a record of thought.

If you want to follow, go ahead. My profile’s public: polymarket.com/@Nutildah. Address 0x413d1FF09fA67C08d9bF295eA4804a26Cc02d704.

No fanfare. No cult. Just trades, logic, and time.

Leave a Reply