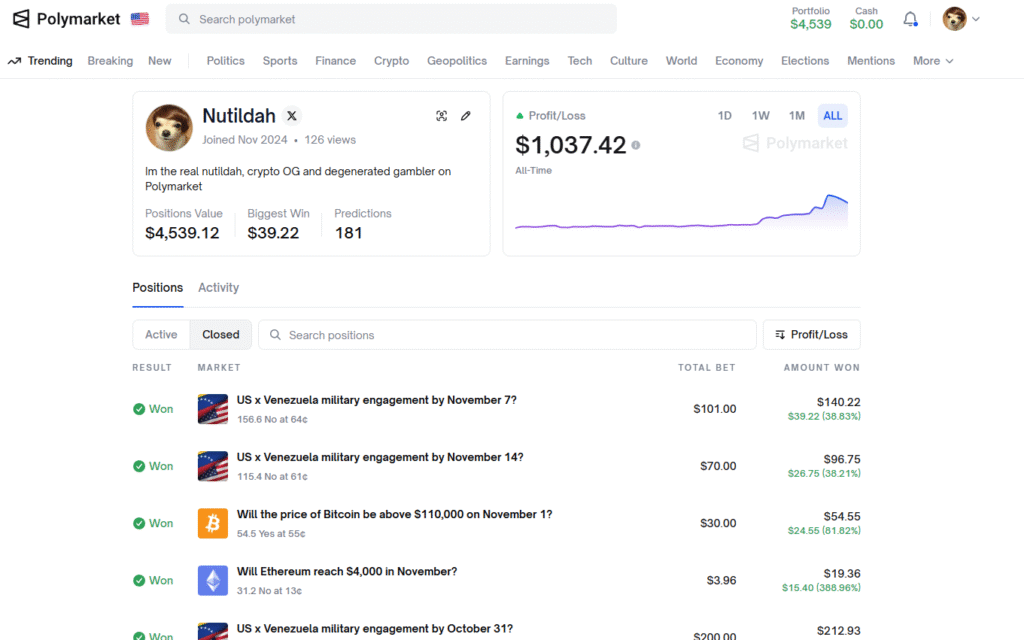

I didn’t plan this. I rejoined Polymarket just a few days back. I came back to check markets, not to turn it into a job. In four days I pushed my profit past $1,000. No hype. No smoke. Just pattern reading and grit.

FIRST STEPS

I had an old account, but I only restarted trading this week. I started small. A few bets to feel how prices moved. Then I saw the same pattern repeat. People panic first. They reason later. That gap is where the money sits.

THE BIG BETS

My biggest wins came from selling fear. Most of my positions were “No” on geopolitical markets. That was deliberate.

US x Venezuela, multiple expiries. I bought No in several markets between 41¢ and 46¢. I added more as the price dipped. One position was 4,171.6 shares at 44¢. It ran to 66¢. That position alone moved my account a lot.

Other winners:

• US x Venezuela by November 30, bought No at 44¢, sitting at large unrealized gains.

• Bitcoin above $110k, bought Yes at 55¢, sold at a profit.

• Ethereum reaching $4,000, bought No at 13¢, big payoff.

You do not need inside info. You need to know how headlines translate to prices. When a news thread screams war, the Yes price spikes. When nothing happens, No recovers. That recovery is profit.

PATTERN RECOGNITION

Markets trade emotion. The louder the fear on social feeds, the more mispriced the market becomes. You can measure panic by how quickly a market moves on a single tweet or report. When it leaps, you buy the opposite if the real-world trigger is unlikely.

Timing matters. I avoid 15 minute bets. I look for markets that give time for headlines to cool. That lets probability win over panic.

NOT EVERY TRADE WINS

I lost too. I bought No on a drug boat strike market and took a hit. I also mis-timed a Chilean election bet. Those were timing errors. I pressed because I felt right, not because the edge was clear.

Losing keeps your rules honest. You learn faster when you lose small.

HOW THE ACCOUNT GREW

This was not weeks. It was days. I restarted this week and compounded gains fast.

Day 1, small entries and testing.

Day 2, added to No positions on Venezuela and a couple of crypto plays.

Day 3, several markets moved and I took profits.

Day 4, account crossed four digits in profit.

I did not add fresh capital to inflate numbers. I recycled profits. I kept each position limited to a slice of my bankroll. That let winners compound without risking everything.

UNDERSTANDING THE NO LOGIC

No is usually cheaper and less volatile. It pays when stories fade. If you buy No early, you benefit each day that passes without the event. Time is on your side.

Example positions:

• US x Venezuela No at 44¢ to 66¢. Roughly a 49% move.

• US x Venezuela by March 31 buy No at 46¢ to 53¢. Small gain, steady.

• Maduro out in 2025 No bought at 73¢ and sold later at a higher price.

You are selling insurance to people who want drama. They buy Yes because of headlines. You sell the calm.

RISK MANAGEMENT

I never bet more than 5 to 10 percent of my total per position. That rule saved me from big swings. Discipline matters more than smarts.

My rules:

• Skip markets you cannot explain. If you do not know the trigger, do not trade.

• Do not chase quick moves. Polymarket fees and slippage punish impulsive trades.

• Ignore crowd noise. The louder the trend on X, the better your counter bet.

• Take chips off the table at 60 to 70 percent profit. Greed kills runs.

SMALL HITS SHARPEN YOU

Micro markets taught timing. I traded Bitcoin up or down during short intervals and doubled small stakes. Those are not big wins alone. They build confidence and muscle memory.

Examples of quick wins:

• Bitcoin micro markets with 60 to 110 percent on short bets.

• A Trump word bet that doubled. Cheap and weird markets like that are edge if you know the event.

DISCIPLINE OVER EXCITEMENT

Most people trade like they dig for a lottery ticket. They chase 10x. They do not see the steady 30 to 80 percent trades that stack.

Polymarket rewards patience. Buy when fear peaks. Wait. Sell when the market calms. That process is boring. It is also profitable.

WHY I STICK TO POLYMARKET

No leverage. No hidden books. Everything is transparent. Your history and P/L are public. You cannot fake outcomes here. That honesty keeps the game honest.

Polymarket forces you to think in probabilities. You win by being right more often than wrong and by sizing bets so losses stay small.

WHAT’S NEXT

I will scale up carefully. Longer dated political and economic markets interest me. Those markets move slower. They also offer asymmetric payoffs if you spot mispricing early.

Short term goal: keep profits growing without emotional trades.

Long term goal: repeatable process. No blowups.

FINAL THOUGHTS

People lose because they follow noise. They react to headlines. They forget probability.

The edge is simple:

• Bet small.

• Bet early.

• Bet against hysteria.

In four days I turned a restart into a four digit profit. Not luck. Pattern recognition plus rules. You do not need to be loud to win. You need to be right.

PORTFOLIO SNAPSHOT NOW

• Total value about $4,500.

• All-time profit above $1,000.

• Active positions focused on No in geopolitical markets.

I am still a degenerated gambler. Now I have a profit to show for it.

— Nutildah

Leave a Reply